How to manage taxes like GST, GST TDs and Income tax TCS etc. in opencart admin panel

Please know that to manage the taxes we have to follow below instruction.

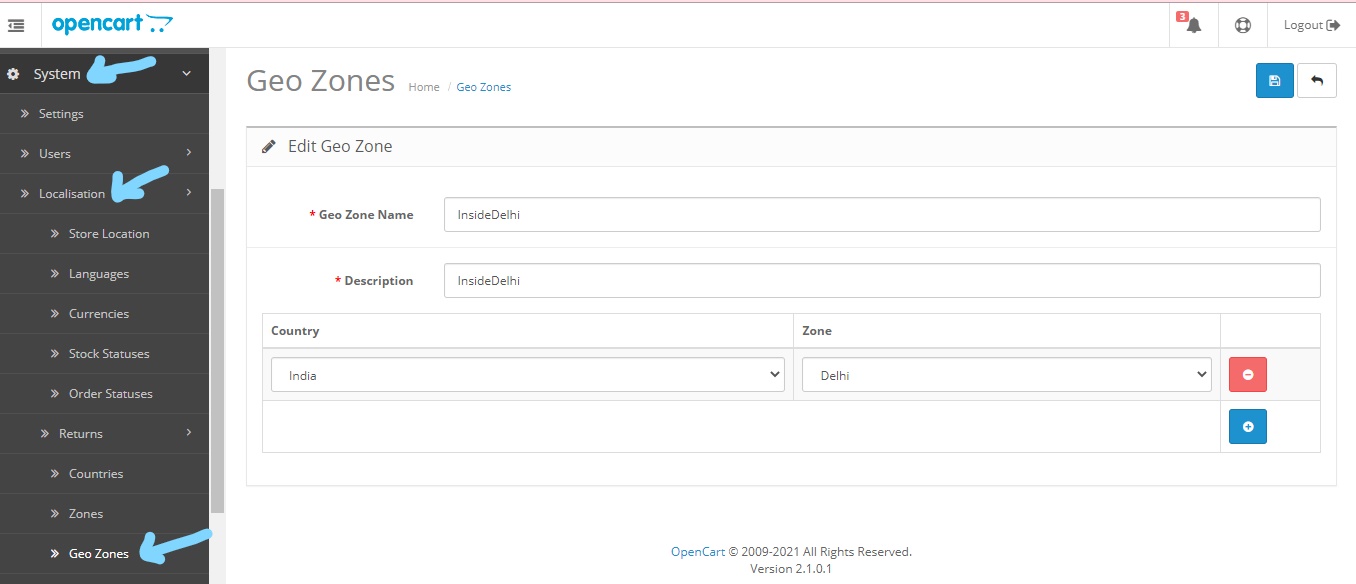

Step-1: Login into admin panel of Opencart.

Then go to System – Localisation – Geo Zones – Add new.

I am considering Delhi as my source state. So we will make InsideDelhi as my one Geo Zone. You can make your own state as per your source state of your products. please see the screenshot below.

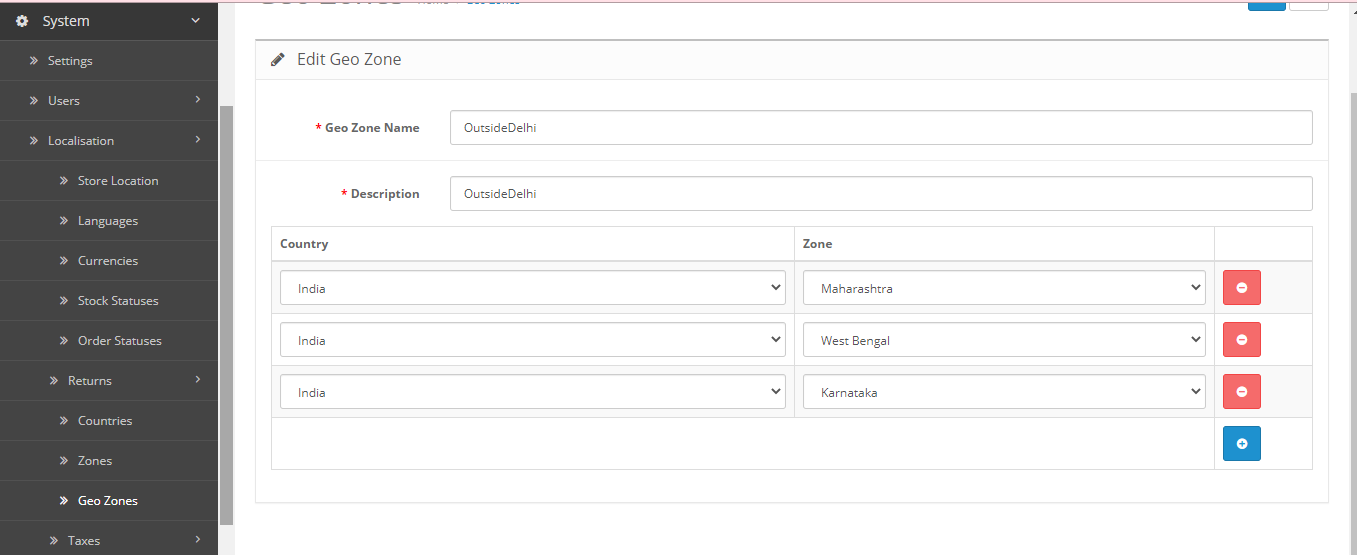

Step-2: Now we will make rest of state as second Geo Zone called OutsideDelhi. It should contain all states outside delhi please see the attached screenshot below.

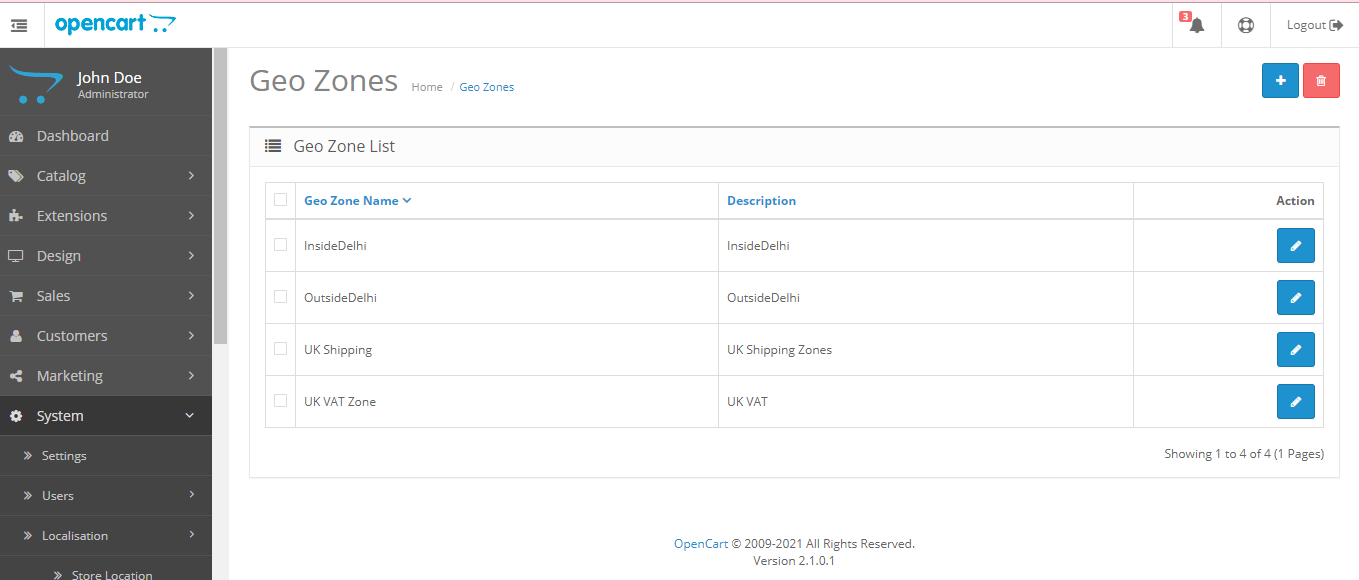

So we now have to setup 2 GST geo zones for India. please see the attached screenshot below.

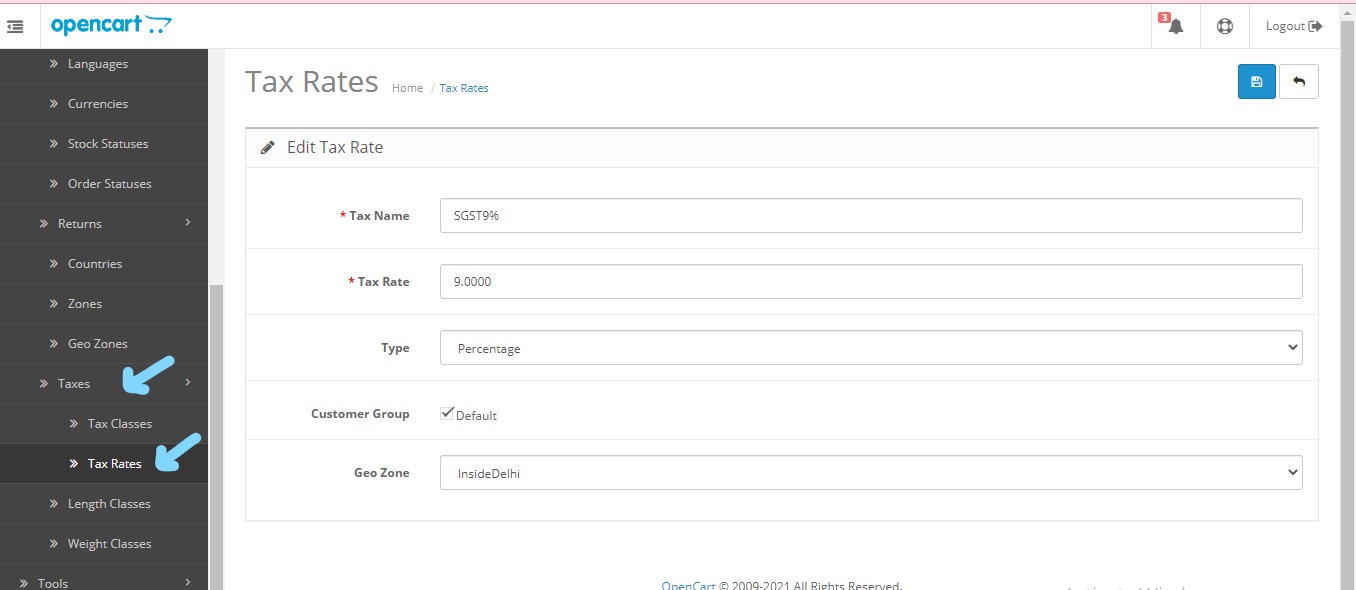

Step-3: Now go to System – Localisation – Taxes – Tax rates – Add New

We will first setup taxes within state which will be SGST and CGST.

Suppose total tax is 18% so it shall be 9% each for SGST and CGST.

You can see below SGST 9% for geo zone as Inside Delhi. please see the attached screenshot below.

Step-4: Now we set up CGST 9% for geo zone as InsideDelhi

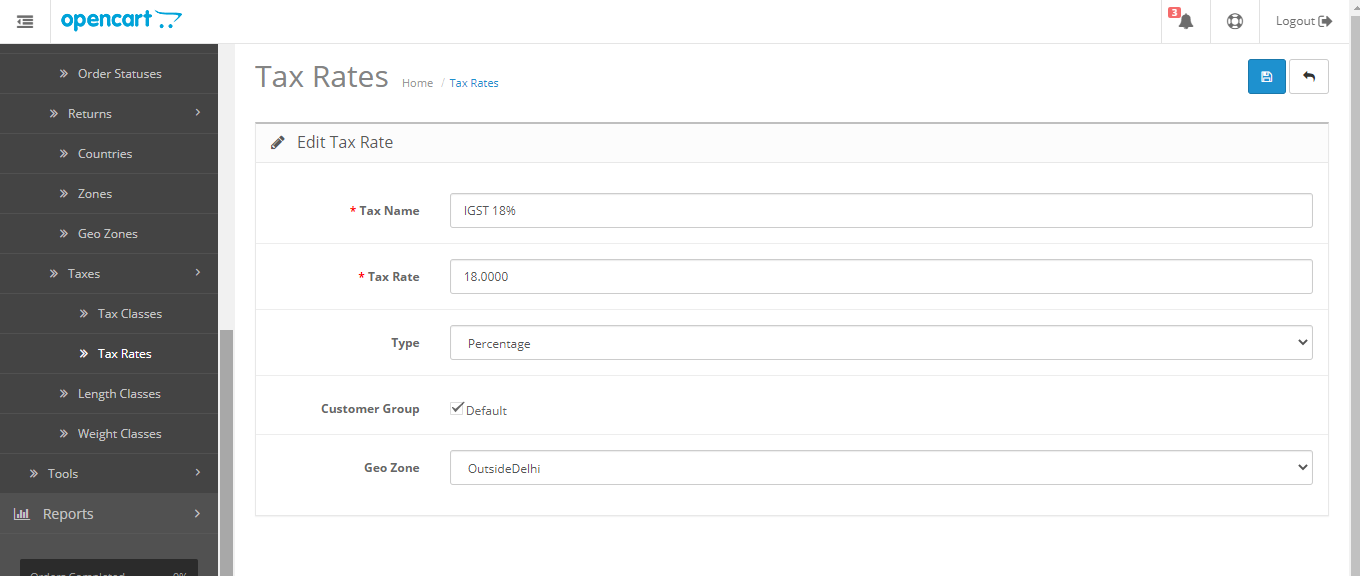

Step-5: Now we will make IGST 18% for sales outside state .please see the attached screenshot below.

Similarly we shall create 2 more tax rate Ex: 12% GST, 28% GST.

Step-6: Now its time to create a new tax class for 18%, 12%, 28%

So go to System – Localisation – Taxes – Tax Classes Add new.

We have created 18% GST and

Comments :

Add your valuable comments, so others can read.